Seeding a Viable Economic Alternative. Pt 1: The Action Plan (Outcomes of a Systems Workshop at Future Connections 2012)

This article is the first in a 4 part series relating to a soft-systems workshop Arkadian ran at Futures Connections 2012. The first 2 parts deal primarily with the outcomes of the session, whilst in the latter 2, Arkadian will be setting out some personal thoughts resulting from the analysis.

Participants were 20 PhD candidates from universities across Scotland, representing a broad variety of disciplines. All were conducting Research on the theme of Sustainable Development.

Since Futures Connections, the outcomes of this workshop have informed the decision-making of another project in which Arkadian is involved: An Tearman, on the Isle of Bute. An Tearman is an experiment in enacting a new socioeconomic model (‘Wisdom Economy’) involving a broad range of stakeholders. A prototype ‘blueprint’ heavily influenced by Permaculture principles is slowly emerging.

Since Futures Connections, the outcomes of this workshop have informed the decision-making of another project in which Arkadian is involved: An Tearman, on the Isle of Bute. An Tearman is an experiment in enacting a new socioeconomic model (‘Wisdom Economy’) involving a broad range of stakeholders. A prototype ‘blueprint’ heavily influenced by Permaculture principles is slowly emerging.

As the ideas generated by the workshop have contributed to the An Tearman project, so too have Arkadian’s learnings fed back into the current analysis, impacting on interpretations, and resulting in some development of the original workshop material, particularly in Parts 2, 3 and 4.

Next episode, we shall be discussing 4 Themes that pervaded the discussion, and in the last two installments, we’ll explore some ideas pertaining to the session outcomes. However, to begin we will outline the aims and structure of the workshop and describe its main outcome: An Action Plan for seeding a Viable Alternative.

The session’s Overarching Aim was:

WHAT?: To seed nationwide sustainable development.

HOW?: By building a self-sufficient and sustainable Community which demonstrates an inspiring, working model of a viable alternative to the current economic system.

WHY?: Because if we desire a tolerable future, there is an urgent necessity to begin our transition to a sustainable economy.

Participants were asked to consider 3 questions:

WHAT Personal Project would you bring to this Community?

HOW would it contribute to the Overarching Aim?

WHY is it important?

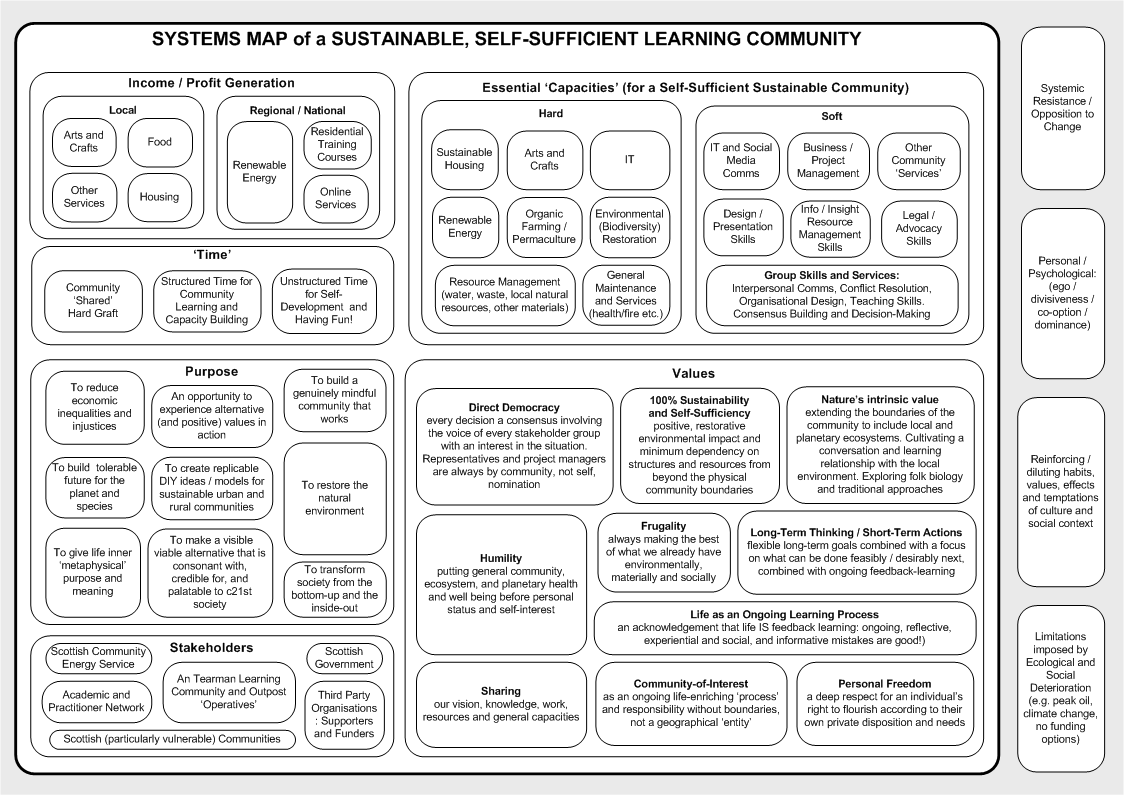

Responses were written on Post-Its in private and stuck randomly on a wall in What? / How? / Why? groups. The result fueled the group discussion. A Systems Map representing rough categories for the Post-Its and main topics of conversation appears below.

The main outcome of the session, unexpectedly, was an Action Plan for seeding nationwide sustainable development. This was as follows:

1. Set-up a Prototype Not-for-Profit Learning Community, which incorporated all the essential capacities of a nationwide sustainable Viable Alternative to the current economic system (see Systems Map: Essential ‘Capacities’). In other words, a ‘whole-system’ Prototype in miniature.

The original Community is envisioned as a cross-pollination of practical experiment and virtual network. At the outset the burning objective of the practical experiment is to generate zero impact revenue streams and become profitable (see Systems Map: Income / Profit Generation).

The virtual network is comprised of experts representing a wide variety of disciplines and experiential backgrounds who, whilst unable to commit substantial time to the practical experiment, are willing to contribute to decision-making whenever situation-specific expertise is required.

Community Time is split equally three ways:

(i) Collaborative physical transaction with the natural environment.

(ii) Structured time for community activities and decision-making. While this also includes the management of social groups and events, the major proportion of this time involves mindful and transparent group reflection upon both the practical experiment and social dynamics. Models, measures-of-success and next step actions are then co-calibrated in response to what has been learned.

Overarching decision-making and consensus-building are all highly-structured processes. They are third-party facilitated and knowledge is externalised using visual tools so as to depersonalise and depolarise opinion. All members are always involved, irrespective of subject, age or expertise. Thus, judgments and learning are informed by the broadest diversity of experience, and the emerging blueprint for the Viable Alternative is shared by all.

(iii) Unstructured time for personal development according to individual inclination. Spiritual, knowledge and skill development, leisure and recreational activities, time for special relationships, FUN? This is ‘You’ time, however you wish to spend it.

One of the central aims of the physical experiment is to generate a minimum of 4 free days every week for (ii) and (iii). Whilst profitability is undeniably important, it plays, and will always play, second fiddle to the meeting of the Community’s deeper non-material needs.

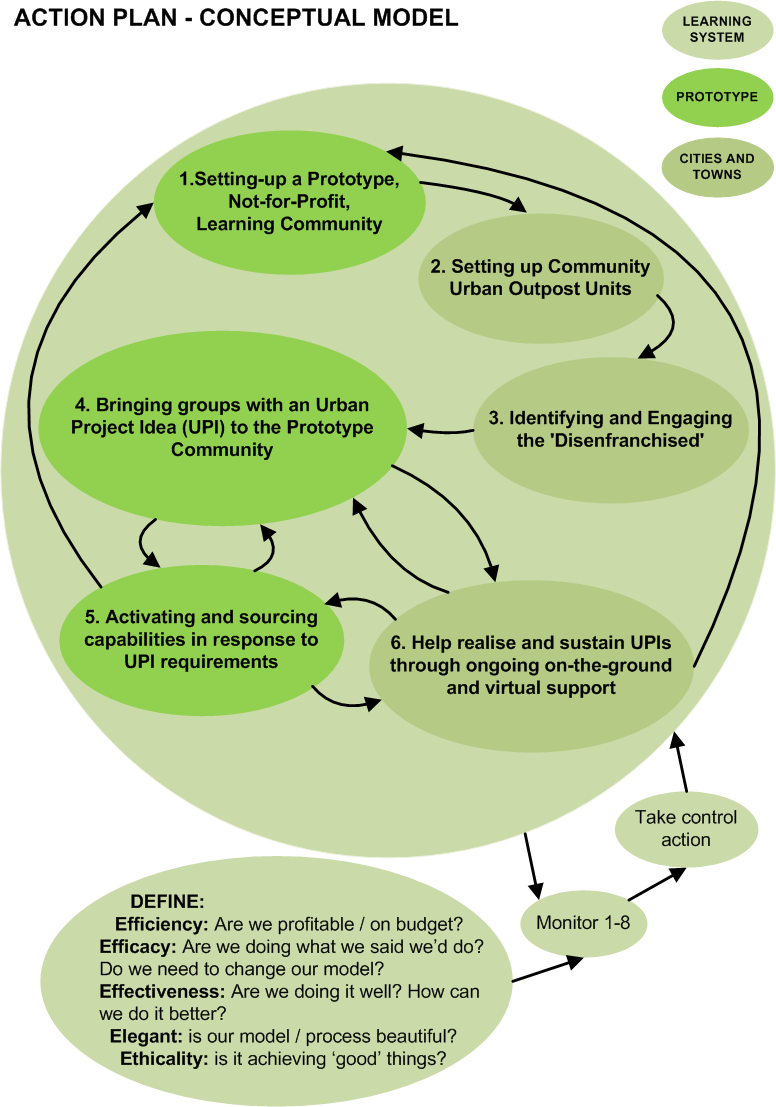

2. Setting up Community Urban Outpost Units. Now that our Prototype is stable, we use some of our assets to fund the despatch of ‘advocates’ to cities and large towns. As urban areas are where the current economic system is most resistant to change and its inequities are suffered most acutely, we believe it is here that successful exemplars of a Viable Alternative will achieve the most resonance.

2. Setting up Community Urban Outpost Units. Now that our Prototype is stable, we use some of our assets to fund the despatch of ‘advocates’ to cities and large towns. As urban areas are where the current economic system is most resistant to change and its inequities are suffered most acutely, we believe it is here that successful exemplars of a Viable Alternative will achieve the most resonance.

3. Engaging the ‘Disenfranchised’. Our advocates seek out and engage those groups that have a vested interest in a Viable Alternative. Perhaps the most obvious are young and disadvantaged peer groups, who have social capital but a bleak, hopeless future under the current system. We share the Prototype ‘blueprint’ with them, and encourage them to think about how they could positively transform their own environment in order to meet local needs.

3. Engaging the ‘Disenfranchised’. Our advocates seek out and engage those groups that have a vested interest in a Viable Alternative. Perhaps the most obvious are young and disadvantaged peer groups, who have social capital but a bleak, hopeless future under the current system. We share the Prototype ‘blueprint’ with them, and encourage them to think about how they could positively transform their own environment in order to meet local needs.

4. Bringing groups with an Urban Project Idea (UPI) to the Prototype. Groups with strong ideas, a willingness to learn, and a commitment to implement their UPI, are invited to the Prototype for experiential immersion in Community work, principles, values and decision-making. Stepping ‘outside’ of their everyday lives enables the groups to reflect upon their UPI with greater clarity and objectivity, and plan free of those shadowy constraints – models, relationships, habits, cues etc. – that hamper decision-making within context.

The group’s transition into participating in our emergent ‘blueprint’ is facilitated gently and mindfully. It is important we allow time for them to grasp the Prototype’s holistic model and processes, for their UPI to gestate, and for two fragile social systems (Prototype and group) to adapt to each other and reach the equilibrium necessary for them to operate effectively together.

5. Activating and sourcing capabilities in response to UPI requirements. When the group ‘feels’ sufficiently clear about their UPI, they are given the opportunity to conduct a Pilot within the Prototype.

The Community participates in related decision-making with openness and humility, seeing each UPI as an opportunity to learn and expand our own capacities. Mindful efforts are made to ensure that development is always under the direction of the group, and that our role remains that of a receptive enabler: sourcing and contributing specialism, materials and encouragement in response to the Pilot’s prevailing needs.

6. Helping realise the UPI through ongoing on-the-ground and virtual support. Upon completion of a successful Pilot, the group returns to their city or town to implement their UPI. By this time, they are equipped with ‘blueprint’ and experiences of a working Viable Alternative, and the skills to bring forth their own unique interpretation by transforming their local urban environment.

Throughout the realisation of their UPI, we continue to provide moral, specialist and financial support, and a sanctuary for retreat, review and restoration in the face of setbacks and systemic resistance.

UPIs are never colonies or subsidiaries, but rather lateral extensions of an expanding, highly interdependent Learning System. This emergent ‘Viable Alternative in action’ is held together by mechanisms that reinforce interrelationships: ritual gatherings where intent, principles and values are collectively reviewed, work and insights shared, and fun had. In the interim there are ‘dovetails’ – members whose role it is to participate in the decision-making processes of two constituent groups, thus facilitating the continuous flow of social learning through the whole system .

Although language may have represented this Action Plan as a linear sequence of stages, it was conceived as something more dynamic, reflective and feedback-driven, better captured visually in the Conceptual Model below.

And so ends our look at a possible ecology for a Prototype Viable Alternative, and an Action Plan for how it might seed nationwide transition bottom>up, inside>out and city>rural by way of an emergent Learning System.

To conclude this installment, possibly the most notable characteristic of the Action Plan on face value (particularly, one designed by a group of stakeholders operating at the leading-edge of sustainable development) is its humility. Perhaps when the scale, complexity and uncertainty of the challenge we face is spread across a wall for all to see, the only reasonable response is to design a system that acknowledges its own ignorance, creates the future one step at a time, and builds collective experience, reflection, experimentation and endeavour into its core DNA?

We hope you’ll join in a fortnight for Part 2, when we shall be exploring the four major themes that pervaded and informed the discussion of the Action Plan.

The Root of all Evil: how the UK Banking System is ruining everything and how easily we can fix it.

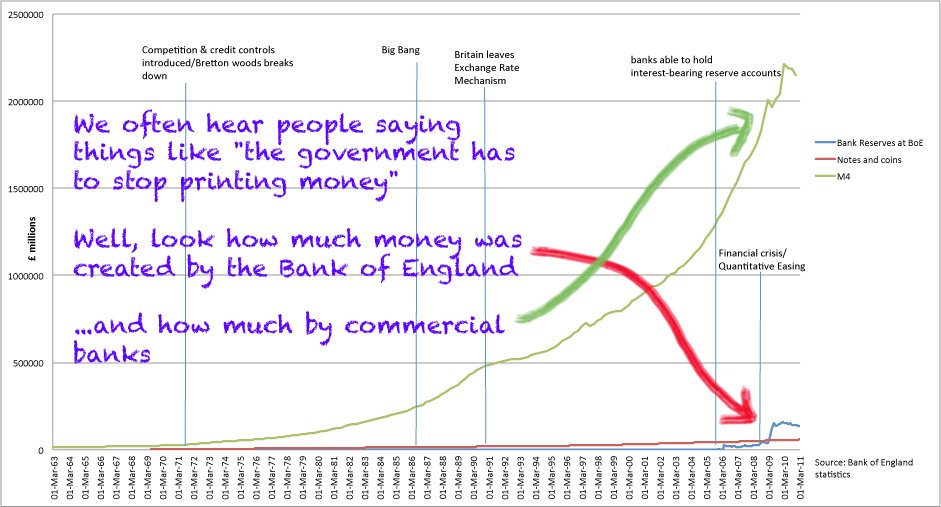

Whilst no economics ‘expert’, it has become clear to Arkadian from evidence presented by organisations such as Positive Money and the New Economics Foundation that the UK Banking System is (i) rapidly driving us into a new Dark Age and (ii) not nearly as difficult to understand as those with a vested interest in it would have us believe.

As positive change depends on a general understanding, the current article aims to compare, in simple terms, how this system has worked in the past, and should work, and how it works currently to the detriment of you, your children, your community and your future.

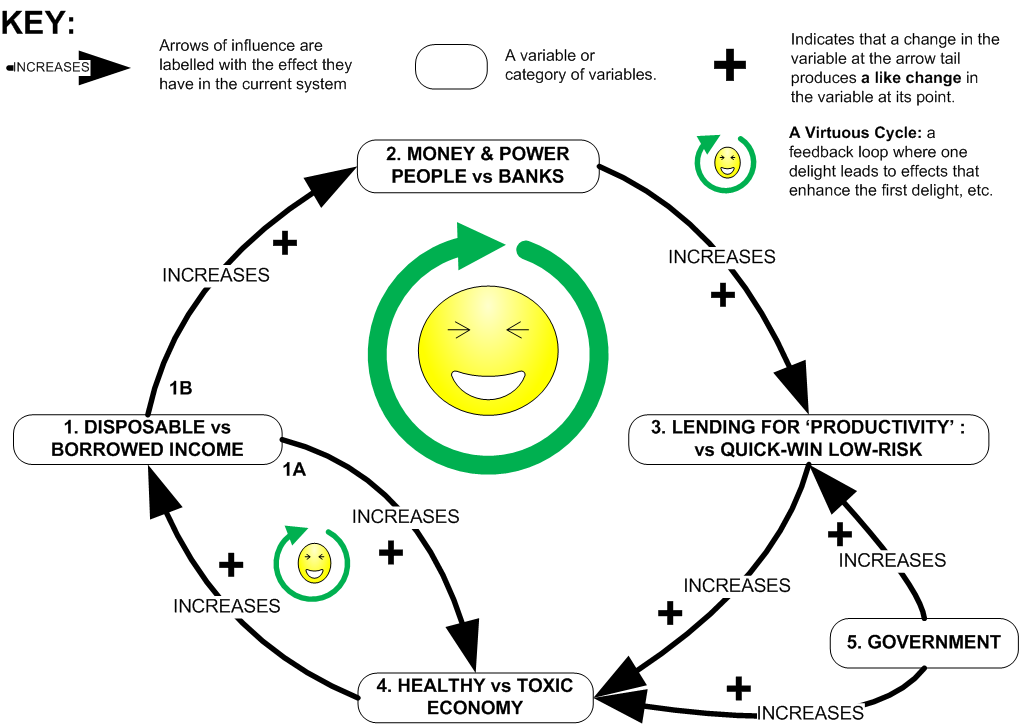

HOW IT WORKED (THE VIRTUOUS CIRCLE):

To begin, lets look at a diagram of how the UK economy worked in the years following WWII. At that time the country, as now, was stone broke but, unlike now, was driven by people-centred values sharpened in response to the Axis Power’s policies of dehumanisation. It is also a model of a ‘classic’ Capitalist System, as described by Adam Smith. Most people, and politicians, still mistakenly believe it works this way.

The arrows represent the flow of money, and the boxes: important ‘variables’ in the system. You can start anywhere, but it’s probably easiest to start with the box to the left.

1. Disposable vs Borrowed Income. You made a decent living in a secure job-for-life that allowed plenty of free time for friends and family. Your mortgage aside – which took around 10-15yrs max to pay off – you only bought things if and when you could afford them, thus putting money back into ‘circulation’ (arrow 1A). The remainder went into your savings account or share investments (arrow 1B) …

2. Money and Power: People vs Banks. …Banks were dependent on your savings to function as they were only permitted to lend in relation to their cash reserves. Their business worked by making money from the interest on these loans…

3. Lending for Productivity vs Quick-Win Low-Risk…As banks were still very much focused at a High Street level, much of their investment went into small businesses…

4. Healthy vs Toxic Economy…Thus your savings helped foster a growing, diversifying and stable local economy, which meant more secure jobs and, coming full circle, (1) more disposable income for other people to spend or save as well as a range of other social benefits associated with greater income equality.

5. Government, meanwhile, ‘governed’ the system to ensure it worked properly. In partnership with the Bank of England, they monitored the economy, periodically injecting new printed cash into the system to fill the ‘gap’ created by new growth, via public services that safeguarded citizens’ life dependencies (energy, social security, education, policing, health, telecoms, transport, postal service, military) and provided reliable employment for millions. They also regulated the banks to ensure they lent justly and responsibly.

And so it worked, by no means a well-oiled machine but still one guided by principles of fairness, general well-being, and economic restraint. So what’s changed?

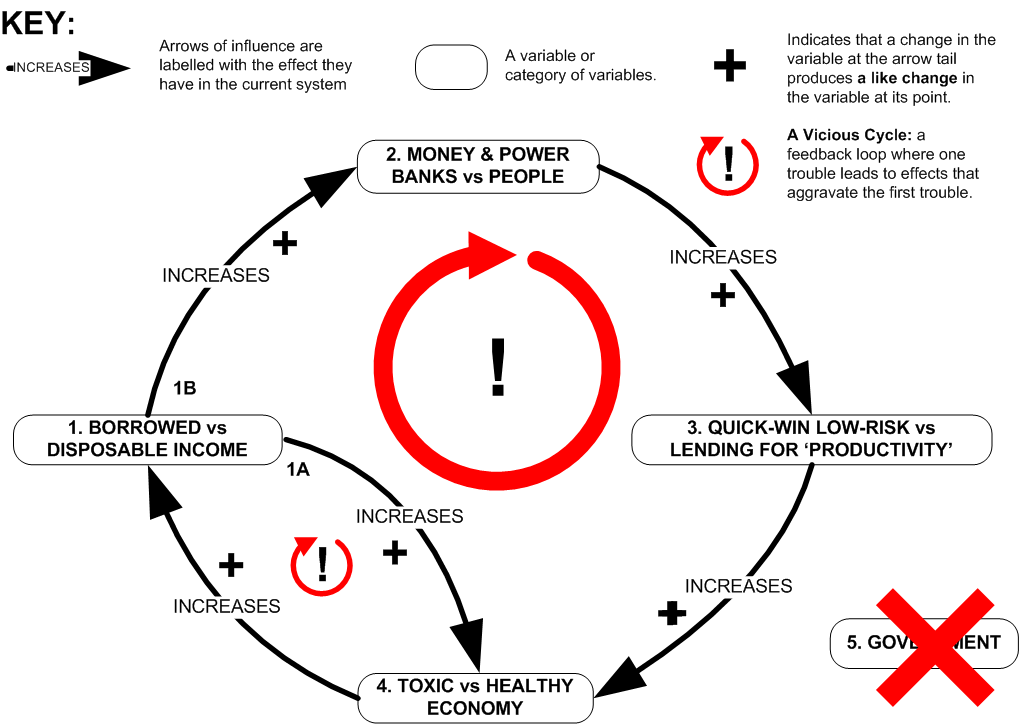

HOW IT WORKS NOW (THE VICIOUS CIRCLE).

1. Borrowed vs Disposable Income. Whilst you (unlike many) may still make a decent living, you and your partner work doubly-hard out of fear of losing your jobs and being unable to meet your mortgage and debt repayments.

In your absence, your children are raised largely by others. Even when you’re home, it’s tough to find energy for them when what you need is relaxation from the stresses and strains. The cost of a property sufficient to comfortably house your family has meant you’re probably destined to spend your whole life surviving on credit and without savings…

2. Money and Power: Banks vs People…But isn’t ‘no savings’ an issue for the banks? Not anymore! Now, when you need to borrow, they are free to tap the number into a spreadsheet and create it for you out of thin air, irrespective of the amount of ‘savings’ in their reserves (arrow 1B) . They also decide your interest rate: the ‘money-for-nothing’ (quite literally) from which they’ve grown rich, politically-powerful and monolithic…

3. Quick-Win Low-Risk vs Lending for Productivity…And these global giants no longer have time for long-term, high-risk investment, such as small or ‘ethical’ businesses. They plough your ‘interest’ into quick-win low-risk high-return investments, which are safely recoupable should anything go belly up.

Around 90% goes int0 speculation, contributing virtually nothing to the economy, and, in the case of the food and currency markets, causing the suffering and deaths of millions in poorer countries. Much of the rest goes into property, and loans to big corporations that value short-term profit over the welfare of planet and people – fossil energy, mining, factory farming, mass media, consumer goods, processed food, the military etc.

4. Toxic vs Healthy Economy…Although in good times the economy appears to grow, growth no longer signifies health. Property prices inflate beyond the reach of many: notably, your descendants. Private monopolies supplant public services and local business, and we become increasingly dependent upon them for life essentials, employment, and a functional economy…

5. Government… So where are they in all this? Precisely! As mentioned in (2.), they’ve handed over the lion’s share of the responsibility for creating and managing the nation’s money to the financial sector. They’ve also permitted a few banks, and other monopolies, to grow so large and powerful that political success now hangs upon prioritising their interests over those of their electorate (with over half of Conservative Party funding now reliant on the banking sector and much of the remainder coming from defence, manufacturing and energy, is it any surprise that voter needs should come second to their sponsors’ return on their investment?) Whilst Whitehall may maintain the illusion of steering the British economy, technically they can’t because they’ve abdicated the controls.

And so the Vicious Circle turns, with each cycle the system becoming more unequal, uniform and unstable. There are three particularly vicious aspects of this system worth noting.

Firstly, it functions irrespective of recession. In boom, you borrow to get the things to which you aspire now rather than having to wait – using credit / store cards, bank loans, mortgages and the like – and the banks get rich and powerful. In bust, you borrow to make ends meet and the banks get rich and powerful.

Secondly, in a recession, because the vast majority of the money in the system is ‘borrowed’, to prioritise the repayment of the bank-invented debt (i.e. ‘Austerity’) over strategies for stimulating spending is guaranteed to shrink the economy further. Simply put, if pennies are taken out of the national purse and vanish into thin air without any being put back in, there will be less money in the purse. Unless, of course, we can find a bank to lend us a more.

Thus, whilst the historically-proven formula for economic recovery has always been to kickstart the Virtuous Circle through public spending and corporate regulation, in this sick misshapen world, crashes, austerity, privatisation and price hikes are great because they force us to borrow more, which indirectly results in new ‘imaginary’ money getting injected into the economy (arrow 1A).

And although a life of indebtedness for food, housing, clothes, education and so on, may promise an increasingly bleak existence for us and our children, for the environmentally-unconscious one-stop corporate shop that creates our credit, charges our interest, employs us as temps at the minimum wage, and is the only place where we can buy anything, it’s a field day.

Lastly, the unsustainability of this rampant money creation is largely irrelevant to the banks because, ultimately, the public debt is underwritten by the Bank of England, in other words, US! You, yes YOU, are effectively part-guarantor of everybody’s loan, including your own. The bubble will always burst, and more spectacularly each time, and it’ll always be you that is liable for the debt, never those that made billions from the recklessness.

Happily, fixing the system is remarkably simple. You have two choices. The easiest is to pick up the phone and (1) MOVE YOUR MONEY out of the Vicious Circle and into an ethical bank such as The Coop or Triodos, who maintain a responsible lending policy, consult you on your ideas for a better future and invest in them – organic farming, renewables, community development and so on – rather than whatever horror brings in the profits. Do it now and enjoy looking your children in the eye with a clear conscience!

(2) is to PUT PRESSURE ON YOUR GOVERNMENTAL SERVANTS to re-impose the vital framework that regulated the Virtuous Circle.

Most critically, this means returning the responsibility for money creation to The Bank of England. Exercise of this responsibility should involve the immediate injection of real cash into circulation (‘quantitative easing’) via investment in a growing public sector and green transition. This would reduce our economy’s toxic dependence on debt to function, generate employment and spending (the only way out of recession), and begin the change upon which a tolerable future hinges.

Close second, however, involves excising the corporate influence from our political system and allowing the democratic needs of citizens to determine Governmental decision-making, and not the insatiable greed of a small commercial oligarchy.

Thirdly, the ‘ecology’ of the financial sector should be regulated so that a significant percentage of banks are always focused on investment at the local level. This is the approach in Germany, and the greater diversity and stability of their banking system has enabled them to weather the present storm significantly better than most.

In short, if you wish to remain in a world where you are dependent on corporate monopolies for your existence, and where the conditions of your life and planet are certain to deteriorate, then sit back and do nothing. However, if you’d prefer a return to a financial system that works towards the common good then MOVE YOUR MONEY NOW!

A concluding thought: in The Early Middle Ages we were told the Bible was only comprehensible and communicable by The Church. It was a tale that, for a considerable time, maintained vision, interpretation, practice and power in the hands of an elite few.

Arguably, the translation of the Bible from Latin into English and its popular dissemination was one of the driving forces behind the development of the more market led and equitable society of later centuries. Knowledge, as they say, is power.

In the c21st our ‘mystery’ is The Economy, our priests: the politicians, economists and bankers. Pah! Economics is easy, isn’t it? It’s just about how we can make money work best for us and our loved ones.

So go on: inform your friends and family. Ask them to move their money too. It’s time to debunk the ‘priesthood’ and reclaim control over our lives, planet and future. Forever and ever. Amen!

Want to know more? Arkadian highly recommends following Positive Money or the New Economics Foundation on Facebook, or watching the illuminating video below. Learn and share!:

Why Corporate Regulation is a Socioenvironmental Necessity. Part 4 of 5: Why does the current Economic System tend towards Uniformity and Instability?

Welcome to the fourth and penultimate episode of a five-part Arkadian analysis which works towards the conclusion in the series title by seeking the answer to a simple question: –

“What difference between natural / social systems and the current economic system causes the former to tend towards diversity and stability, and the latter, uniformity and instability?”

In Weeks 1 and 2, we explored why ecosystems and ‘civilisations’ tend towards diversity and proposed virtuous dynamics (the ‘Diversity Engine’) that power increasingly fine-grained specialisation / cooperation, whilst inhibiting environmental dominance by particular species or social ‘groups’. Last Week, we looked at three examples at different ‘levels’ (social group, societal, global) which illustrated why overall systemic stability and resilience, and, thus, the common good, depends on a shared responsibility for productivity produced by this trend.

Today, we aim to get the crux of the issue at the heart of this series by investigating why the current global economic system behaves in the opposite way.

The last few decades have seen a dramatic global trend towards economic uniformity across most market sectors – most notably and worryingly, finance, media, food and agriculture, and manufacturing. A recent systems analysis by PLos One revealed that a network of 1318 companies directly represent a quarter of global operating revenues and, indirectly, via shareholdings in blue chips and manufacturing, a further 60%. Of these, a super-group of 147 companies, mostly financial institutions controls 40% of the total wealth in the system.

The last few decades have seen a dramatic global trend towards economic uniformity across most market sectors – most notably and worryingly, finance, media, food and agriculture, and manufacturing. A recent systems analysis by PLos One revealed that a network of 1318 companies directly represent a quarter of global operating revenues and, indirectly, via shareholdings in blue chips and manufacturing, a further 60%. Of these, a super-group of 147 companies, mostly financial institutions controls 40% of the total wealth in the system.

This homogeneity has also correlated with a spectacular increase in the scale and financial muscle of global corporations. A 2002 UNCTAD analysis, which used the sum of salaries and benefits, depreciation and amortization, and pre-tax income to compare firms with the GDP of countries, found that a third of the world’s 100 largest economic entities were transnational corporations. The biggest, Exxon, rivaled the economies of Chile or Pakistan; Philip Morris was on a par with Tunisia, Slovakia and Guatemala; and a more recent study research shows General Motors, DaimlerChrysler, Shell, and Sony to outsize Denmark, Poland, Venezuela, and Pakistan, respectively.

Many other corrosive trends have gone hand-in-hand with this expansion. According to statistics gathered by the New Economics Foundation, income inequality is now higher than at any other time in human history with the CEOs of the 365 biggest US companies earning over 500x that of the average employee. Corporate strategies to augment profits – outsourcing, temporary employment contracts, mechanisation and process efficiency – have eroded wages, job satisfaction and security, and human labour productivity, with the world’s biggest 200 transnationals now accounting for a third of world economic activity but employing less than 0.25% of the global workforce.

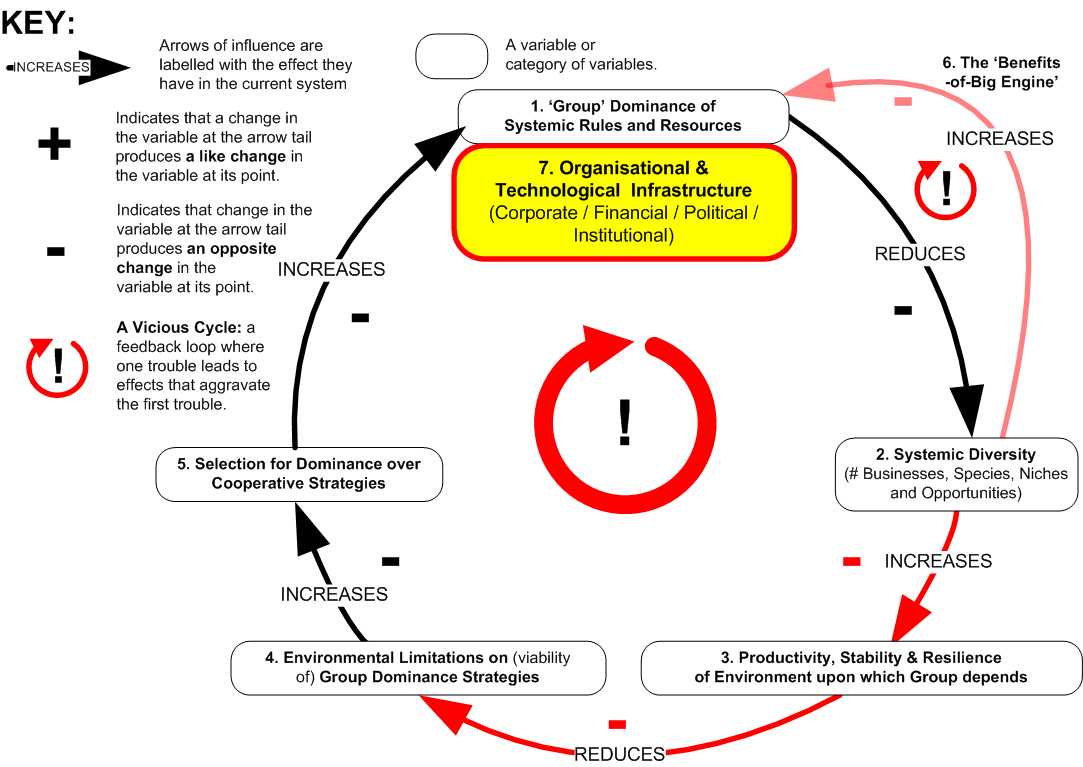

So what are the dynamics underpinning this pernicious trend? MODEL 3 of our analysis below proposes an answer (N.B. If you have trouble reading the text, click on the diagram to open it in a new browser tab and then refer back to the explanation here).

Whilst Model 3 involves more-or-less identical variables to the Models 1 (Ecosystems) and 2 (Civilisations) we explored in Weeks 1 and 2 respectively, there are several critical differences. Firstly, we broaden the definition of ‘diversity’ to include both socioeconomic and natural systems. Secondly, the term ‘group’ (which referred to political elites in Model 2) now refers specifically to the small alliance of people for whom a given corporation is a vehicle of wealth-creation: board executives, major shareholders, higher management and, to a lesser degree, senior employees, i.e. the people who don’t lose their jobs or bonuses during cutbacks.

Thirdly, and most fundamentally, is a change in the polarity of the two arrows (coloured red) connecting variables (2), (3) and (4). Unlike dominant species in ecosystems and ruling elites in political systems, these ‘groups’,empowered by (7) policy and infrastructure that enable vast geographical reach, promote their self-interest and shield them against personal accountability for abuses, are able to reduce systemic diversity without their actions having corresponding negative effects on the stability and resilience of their own local environment.

Thirdly, and most fundamentally, is a change in the polarity of the two arrows (coloured red) connecting variables (2), (3) and (4). Unlike dominant species in ecosystems and ruling elites in political systems, these ‘groups’,empowered by (7) policy and infrastructure that enable vast geographical reach, promote their self-interest and shield them against personal accountability for abuses, are able to reduce systemic diversity without their actions having corresponding negative effects on the stability and resilience of their own local environment.

Indeed, (3) the greater the ‘group’s’ impact on diversity, the more prosperous and secure their personal environment becomes. Thus, in the current economic system, (1, 4, 5 and 6) the drive for dominance of rules and resources is invigorated by growing wealth, social mobility and political influence, unlike ecosystems and civilisations, where it was curtailed by its weakening and destabilising impact on the environment And so it turns: not a Balancing Loop, but a Vicious Circle: a feedback loop where one trouble leads to effects that aggravate the first trouble, and so on.

To exacerbate problems, the absence of limiting environmental feedback also reverses the dynamics of the ‘Diversity Engine’, turning it into its ominous alter ego: a Vicious Circle we’ve named the (6) ‘Benefits-of-Big Engine’.

Here, instead of a trend towards economic diversity facilitating healthy competition and new business opportunities, and making market domination progressively more difficult, a small group of dominant players is able to harness ever greater resources, economies-of-scale and mechanisms of influence (price, lobbying, political office, advertising, media, academia) to overcome existing competition and render future challengers increasingly futile and improbable.

Disturbingly, whilst in nature / society the weaknesses and instability resulting from systemic impoverishment ultimately defeat the dominant species and ruling groups responsible, thereby facilitating a new order, in the current economic system they increasingly further the interests of the corporate ‘groups’ that have caused them.

These giants can downsize, buyout or price-out smaller floundering competition, and their huge economic significance means that, even if things get really bad, national governments are likely to intervene rather than risk the impact of bankruptcy. As touched upon in Week 2, the crisis-stricken financial sector is a perfect example, where after the panic of insolvencies, public bailouts and recession, a run of mergers and buyouts gave birth to a more monolithic, powerful and fragile banking system than ever before.

Possibly the darkest characteristic of ‘The Benefits of Big’, however, is that the larger and more ubiquitous these corporate vehicles become, and the more competitively priced their products and services, the more difficult it becomes for us to avoid participating in their expansionary activities.

Possibly the darkest characteristic of ‘The Benefits of Big’, however, is that the larger and more ubiquitous these corporate vehicles become, and the more competitively priced their products and services, the more difficult it becomes for us to avoid participating in their expansionary activities.

Thus, as customers, suppliers and employees, we all unknowingly or unwillingly, become complicit in dynamics that increasingly impoverish and endanger the systems upon which we depend.

In short, in the current economic system there appears to be no constraint on the wealth-creation of ‘groups’ at the helms of corporations other than a total socioenvironmental meltdown.

Happily, there is much we can do to change this. We hope you’ll join us next Friday for our final installment, when we shall use what we’ve learned from the virtuous ‘Diversity Engine’ of ecosystems / civilisations to propose interventions that could reverse the vicious ‘Benefits of Big Engine’ and create a self-sustaining economic system that benefits people and planet.

Why Corporate Regulation is a Socioenvironmental Necessity. Part 3 of 5: Why does A Diverse System = A Stable System?

Delighted that you’ve joined us for the third installment of our first Arkadian analysis for 2012, where over five short articles, we will show how we reached the series title’s conclusion by way of the following question: –

“What difference between natural / social systems and the current economic system causes the former to tend towards diversity and stability, and the latter, uniformity and instability?”

In Weeks 1 and 2, we investigated why ecosystems and ‘civilisation’ tend towards diversity and stability. It was proposed this was attributable to virtuous dynamics that promote long-term systemic stability and resilience by driving increasingly fine-grained specialisation / cooperation, whilst inhibiting environmental dominance by particular species or social ‘groups’.

Next week we will be putting forward an explanation as to why the current economic system displays the reverse trend but, for now, we thought it worthwhile to explain briefly the connection between diversity and stability. Why exactly does a change in the former result in a like change in the latter?

Put simply, in a diverse system, the health of the whole (‘productivity’) isn’t dependent on the performance of only a few parts.

For example, imagine a disadvantaged family where Dad is the only breadwinner. If he has an accident, no-one eats. If the house blows down in a storm, there’s no-one to rebuild it. Compare the situation with a second family where several other members also contribute to the household income. Because ‘productivity’ is distributed across several people, the overall family ‘system’ is much more able to adapt to an accident-prone Dad and / or a force majeure.

For example, imagine a disadvantaged family where Dad is the only breadwinner. If he has an accident, no-one eats. If the house blows down in a storm, there’s no-one to rebuild it. Compare the situation with a second family where several other members also contribute to the household income. Because ‘productivity’ is distributed across several people, the overall family ‘system’ is much more able to adapt to an accident-prone Dad and / or a force majeure.

A classic instance of systemic over-dependency at a macro-societal level is Ancient Egypt, which teetered on a single variable: the annual flooding of the Nile (taken from the excellent ‘Water’ by Steven Solomon). The ‘inundation‘, as it was known, rejuvenated the plains with fertile silt and washed away soil poisons, to produce the most self-sustaining and fertile farmlands of the ancient world.

A classic instance of systemic over-dependency at a macro-societal level is Ancient Egypt, which teetered on a single variable: the annual flooding of the Nile (taken from the excellent ‘Water’ by Steven Solomon). The ‘inundation‘, as it was known, rejuvenated the plains with fertile silt and washed away soil poisons, to produce the most self-sustaining and fertile farmlands of the ancient world.

The exclusive focus of the political elite was water management: senior priest-managers led departments for overseeing dikes, canal workers and measuring river levels; and top dog, Pharaoh’s, fundamental godly responsibility was mastery of the flow of the great river.

Unsurprisingly then, the Nile and Egyptian history ebb and flow in perfect synchronicity. Without exception, the Old, Middle, and New Kingdoms, as well as the later periods of Greek and Byzantine rule, bloom with the return of the regular cycle of flooding and crumple with climactic dry periods into centuries of disunity, chaos and foreign invasions. Thus, despite many environmental blessings, ultimately, the stability and resilience of this mighty civilisation and its elite were slave to the caprices of its one water source, in a way that a country with abundant springs, rivers and lakes could never be.

Our third and final example – the current economic downturn – illustrates uniformity and instability at a global level. Here, the world’s banking system was rendered so fragile by the interdependency of a few titanic banks and financial services firms, that massive external intervention was required to prevent total meltdown when one of them, Lehman Brothers, filed for bankruptcy in 2009. It is a crisis and an intervention for which we shall all suffer for many decades to come.

Our third and final example – the current economic downturn – illustrates uniformity and instability at a global level. Here, the world’s banking system was rendered so fragile by the interdependency of a few titanic banks and financial services firms, that massive external intervention was required to prevent total meltdown when one of them, Lehman Brothers, filed for bankruptcy in 2009. It is a crisis and an intervention for which we shall all suffer for many decades to come.

But why had the economic system not behaved like the natural / social systems we looked at in Weeks 1 and 2, and become increasingly diverse and stable as it expanded? We hope you’ll drop in next Friday to find out.

Why Corporate Regulation is a Socioenvironmental Necessity. Part 1 of 5: Why do Ecosystems tend towards Diversity and Stability?

Happy New Year and welcome to our first Arkadian analysis of 2012. Over the next five weeks we will be working towards the conclusion of the title of the series by exploring the answer to a simple question: –

Happy New Year and welcome to our first Arkadian analysis of 2012. Over the next five weeks we will be working towards the conclusion of the title of the series by exploring the answer to a simple question: –

“What difference between natural / social systems and the current economic system causes the former to tend towards diversity and stability, and the latter, uniformity and instability?”

In a world where the latter now poses a mortal threat to the former, we considered this to be a question of some significance. Could we learn from the way natural / social systems self-regulate in a way that benefits all, to design an ecologically-and-socially-just economic system?

Our analysis will be set out in five short articles, launching Friday mornings throughout January and early February: –

(1) Why do Ecosystems tend towards Diversity and Stability? Friday 6th January 2012.

(2) Why does (did) Civilisation tend towards Diversity and Stability? Friday 13th January 2012.

(3) Why do Diverse Systems = Stable Systems? Friday 20th January 2012.

(4) Why does the Current Economic System tend towards Uniformity and Instability? Friday 27th January 2012.

(5) How do we create a Diverse and Stable Economic System? Friday 28th September 2012.

So without further ado, let’s move onto our first question of the series:

Why do Ecosystems tend towards Diversity and Stability?

As a general rule the longer that ecosystems remain undisturbed by external factors, the richer they become. The oldest – the rainforests – are estimated to hold over half of all species, despite covering only 6% of the Earth’s surface. Why should 70m years of evolution against a backdrop of dynamic climate fluctuations give rise to increasing variety and not just a few dominant species?

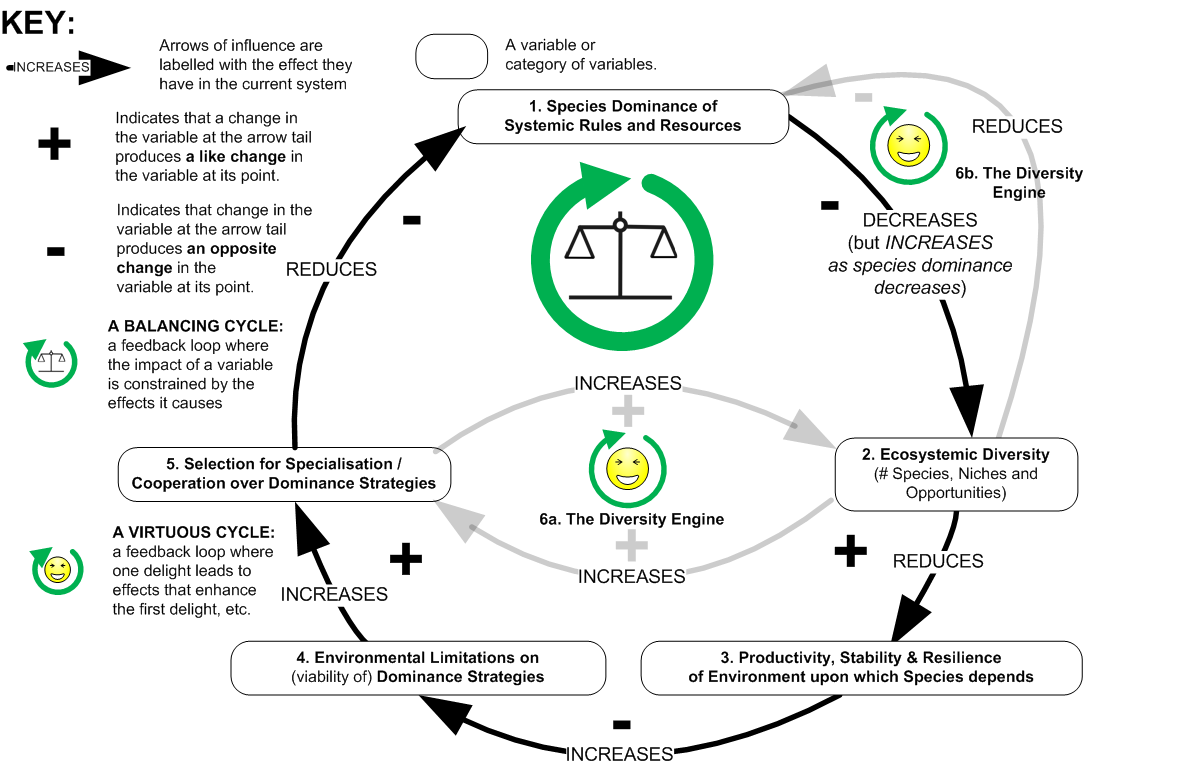

MODEL 1 of our analysis below proposes an answer (N.B. If you have trouble reading the text, click on the diagram to open it in a new browser tab and then refer back to the explanation here).

Begin at the topmost variable and follow the arrows clockwise around the loop. (1) Put yourself in the position of a species that pursues total dominance over its local environment. (2) Despite considerable early successes, it’s not long before your manipulation and consumption begin to impact adversely on other species. (3) As local biodiversity diminishes, so too do the health, resilience and stability of the ecosystem as a whole, (4) resulting in ever-tighter constraints on your actions and, ultimately, the collapse of the environment upon which your own survival depends. (5) Your extinction kills off that suicidal gene that motivated your thirst for dominance, leaving an open stage for adaptive strategies that promote ecosystemic diversity and stability.

Begin at the topmost variable and follow the arrows clockwise around the loop. (1) Put yourself in the position of a species that pursues total dominance over its local environment. (2) Despite considerable early successes, it’s not long before your manipulation and consumption begin to impact adversely on other species. (3) As local biodiversity diminishes, so too do the health, resilience and stability of the ecosystem as a whole, (4) resulting in ever-tighter constraints on your actions and, ultimately, the collapse of the environment upon which your own survival depends. (5) Your extinction kills off that suicidal gene that motivated your thirst for dominance, leaving an open stage for adaptive strategies that promote ecosystemic diversity and stability.

Thus, coming full circle, (1) Your Environmental Dominance Strategy proved self-defeating because it led to Ecosystemic Weaknesses that constrained and, ultimately, negated, You! In Systems Dynamics a feedback loop like this where the impact of a variable is reduced by the effects it causes is called a ‘Balancing Circle’.

A further notable dynamic here is a pair of ‘Virtuous Circles’ (feedback loops where one delight leads to effects that enhance the first delight, and so on), which we’ve termed the ‘The Diversity Engine’.

A further notable dynamic here is a pair of ‘Virtuous Circles’ (feedback loops where one delight leads to effects that enhance the first delight, and so on), which we’ve termed the ‘The Diversity Engine’.

Here, (6a) the more the processes of natural selection incline towards interdependence, the more opportunities are opened up for new evolutionary adaptations. Thus, through increasingly fine-grained cooperation and specialisation between species, diversity itself drives diversity.

Moreover, as the environment grows ever more rich and complex, (6b) species dominance becomes increasingly futile and improbable, removing a further constraint on the trend towards diversity. And so both circles turn.

But (we hear you say) isn’t there a species that has had a radical effect on its local environment but has (thus far) escaped extinction? We hope you’ll drop in next Friday for Part 2, when we shall be exploring the curious exception of Homo Sapiens.

Recent Posts

- Seeding a Viable Economic Alternative. Pt 3: Placing Mother Nature First

- Seeding a Viable Economic Alternative. Pt 4: Ego-as-Process

- Charlie Hebdo and the Immorality Loop

- My Top 20 Waterfalls Pt3 (S America: #2-1)

- My Top 20 Waterfalls Pt2 (S America: #7-3)

- My Top 20 Waterfalls Pt1 (Africa, Asia, Europe & N America)

- Positive Change using Biological Principles, Pt 4: Principles in Action

- Positive Change using Biological Principles Pt 3: Freedom from the Community Principle

- Positive Change using Biological Principles Pt 2: The missing Community Principle

- Positive Change using Biological Principles, Pt 1: The Campaign Complex

- Seeding a Viable Economic Alternative. Pt 2: The Principal Themes (Outcomes of a Systems Workshop at Future Connections 2012)

- Seeding a Viable Economic Alternative. Pt 1: The Action Plan (Outcomes of a Systems Workshop at Future Connections 2012)

- What I Learned from Destroying the Universe

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 5 of 5: How do We Create a Diverse and Stable Economic System?

- The Root of all Evil: how the UK Banking System is ruining everything and how easily we can fix it.

- What is Occupy? Collective insights from a ‘Whole Systems’ Session with Occupy followers

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 4 of 5: Why does the current Economic System tend towards Uniformity and Instability?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 3 of 5: Why does A Diverse System = A Stable System?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 2 of 5: Why does (did) Civilisation tend towards Diversity and Stability?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 1 of 5: Why do Ecosystems tend towards Diversity and Stability?