Why Corporate Regulation is a Socioenvironmental Necessity. Part 5 of 5: How do We Create a Diverse and Stable Economic System?

Welcome to the belated final installment of our five part analysis. We have been working towards the title’s conclusion by seeking an answer to the following question.

What difference between natural / social, and economic, systems causes one to tend towards diversity and stability, and the other, uniformity and instability?

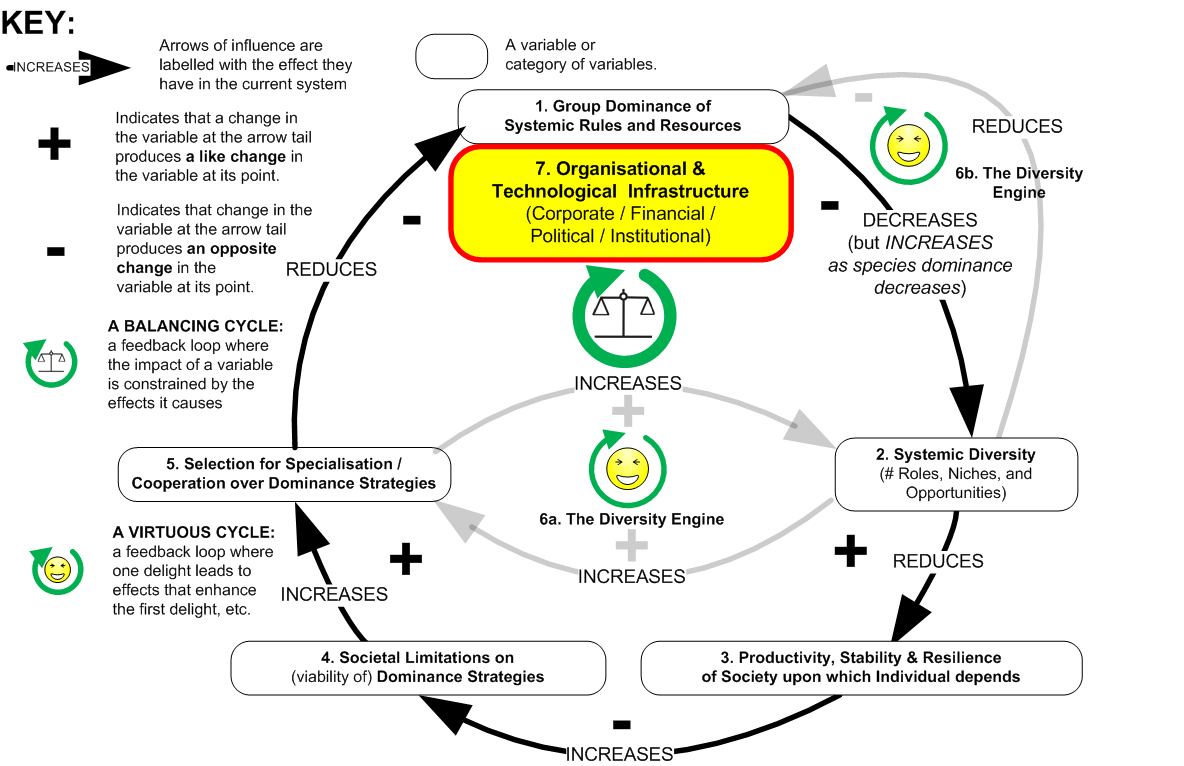

In installments 1, 2 and 3, we proposed that in natural / social systems a species or ‘group’ seeking total domination of their environment are constrained and, ultimately, destroyed by the impoverishing and destabilising effects of their actions on the systems upon which their own survival depends, thus leaving the arena open for dynamics that promote diversity and long-term stability (see previous installments if you need an explanation of the model below).

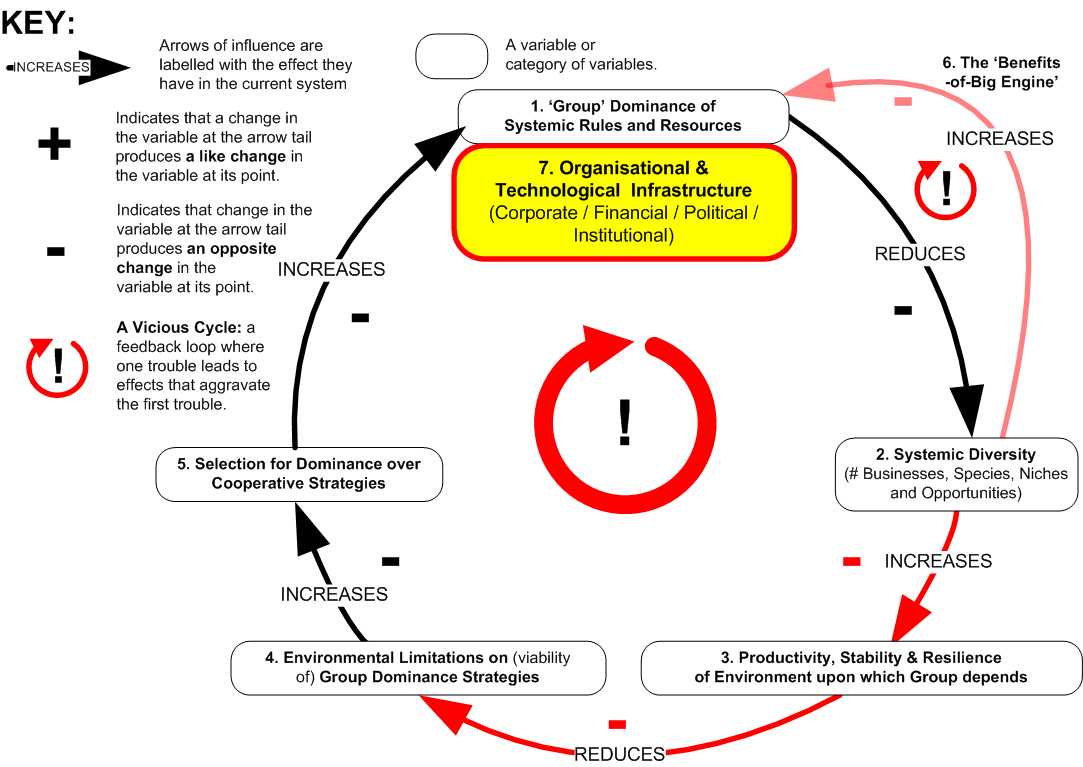

In installment 4 we suggested that the current economic system displays a reverse trend towards uniformity and instability because it allows the small ‘groups’ at the helms of corporations to gain increasing wealth and power from disintegrating social / natural systems without ever personally experiencing the environmental backlash of their actions. (see installment 4 if you need an explanation of the model below).

To clarify, this shouldn’t be taken as a demonisation of businessmen. Some individuals are naturally entrepreneurial, status-driven or materially-oriented, and the prosperity and order we have come to enjoy in recent centuries are largely indebted to their spirit and energy. Indeed, there are few among us that wouldn’t pass up a lottery win and the prestige, security and freedom it affords.

To clarify, this shouldn’t be taken as a demonisation of businessmen. Some individuals are naturally entrepreneurial, status-driven or materially-oriented, and the prosperity and order we have come to enjoy in recent centuries are largely indebted to their spirit and energy. Indeed, there are few among us that wouldn’t pass up a lottery win and the prestige, security and freedom it affords.

However, in the current era, unconstrained profit-and-power motivated vicious cycles represent a mortal threat to our freedom of choice, quality of life and, most urgently, our planet’s life systems. If the virtuous feedback mechanisms that promote diversity and stability in natural / social systems do not function naturally in the current economic system, then they they must be imposed artificially with due haste. But how?

First let’s summarise, in a nutshell, the problem to be resolved…

In the current economic system, dominant ‘groups’ are able to benefit from abusing the diversity and stability of socioenvironmental systems without ever experiencing negative feedback from their actions.

Although many possible interventions occurred to Arkadian whilst writing this series, a coherent regulatory model, which offered an unobjectionable, easy transition from the current economic system was not so easy to imagine (the reason why the final installment has been so long in coming!). Happily, a fully-formed (40yr old) solution presented itself recently in Chapter 19 of ‘Small is Beautiful’, courtesy of the genius of economist, E.F. Schumacher (pictured left).

The Schumacher Business Model, stated simply, rests on 2 systemic ‘tweaks’: (1) limiting the number of people a single corporate entity can employ and (2) introducing meaningful public ownership and accountability into business structure and practice.

(1) Legally restricting corporation size by number of employees. It would seem reasonable that a ceiling should be dictated chiefly by evidence regarding effective human group size (see Dunbar’s number), say between 80-200 persons. Growth beyond the upper limit, Schumacher suggests, should entail the formation of new independent corporate units, which may be linked by joint stock. These restrictions would enable each employee to ’embrace the idea of the business as a whole’ and the value of their role therein, but most importantly to the current argument, it would ensure that ‘the group (i.e. The Board)’ couldn’t claim ignorance of the details of their company activities and, thus, could reasonably be held personally accountable for abuses.

Furthermore, constraining size, particularly when the exploitation of natural / social resources is involved, is also more likely to physically ground a corporation in a local environment. Bringing ‘the group’ closer to their employees and the raw coal face of their realworld transactions is likely to increase their susceptibility and responsiveness to negative socioenvironmental feedback both internal and external to their organisation. It is also liable to curb the scale of impacts of which a single corporate vehicle is capable.

All very well, the cynics may cry, but what of the ‘groups’ with the thicker skins and thinner moral fibre?

(2) Public Ownership and Accountability. Schumacher advises we put an end to annual corporate taxation (a proposition not disagreeable to most businessmen!). In its place he proposes that for every share sold privately by a company, a further share is issued to the public. Thus, as owner of 50% of the company, we’d collectively receive half of any dividends if and when they are paid out to shareholders (he argues that when a company grows beyond a certain size it loses its ‘private and personal character’ and thus can be considered, in a sense, a public enterprise anyway).

To avoid disruption, our public equity wouldn’t allow us any voting rights in everyday business decision-making. It would, however, entitle us to attend Board meetings as an observer and, if the actions of the business were deemed to run counter to the public or environmental interest, we could apply to a court to get dormant voting rights activated.

To avoid disruption, our public equity wouldn’t allow us any voting rights in everyday business decision-making. It would, however, entitle us to attend Board meetings as an observer and, if the actions of the business were deemed to run counter to the public or environmental interest, we could apply to a court to get dormant voting rights activated.

To exercise these corporate responsibilities, Schumacher proposes the creation of independent citizen bodies funded from local business dividends. These ‘Social Councils’ would be split into four equal parts: three would have their members nominated by local trade unions, professional, and environmental, organisations, with the final quarter being drawn randomly from local residents in the manner of jury service. Involvement in management processes would, of course, be bound by strict confidentiality agreements.

Schumacher’s model brings socioenvironmental feedback directly into the Board room both as a ‘possibility in the background’ and, when necessary, as a real, prevailing constraint.

It is Arkadian’s prediction that, over time, exposing the ‘groups’ at the corporate helm to these balancing dynamics would drive a new trend towards macroeconomic diversity and stability, and greater corporate responsibility for the integrity of the natural environment (by triggering the ‘Diversity Engine’, described in installments 1, 2 and 3). And to top it all, it would require minimal design and economic / legal restructuring because, in the main, the model utilises existing frameworks and practices.

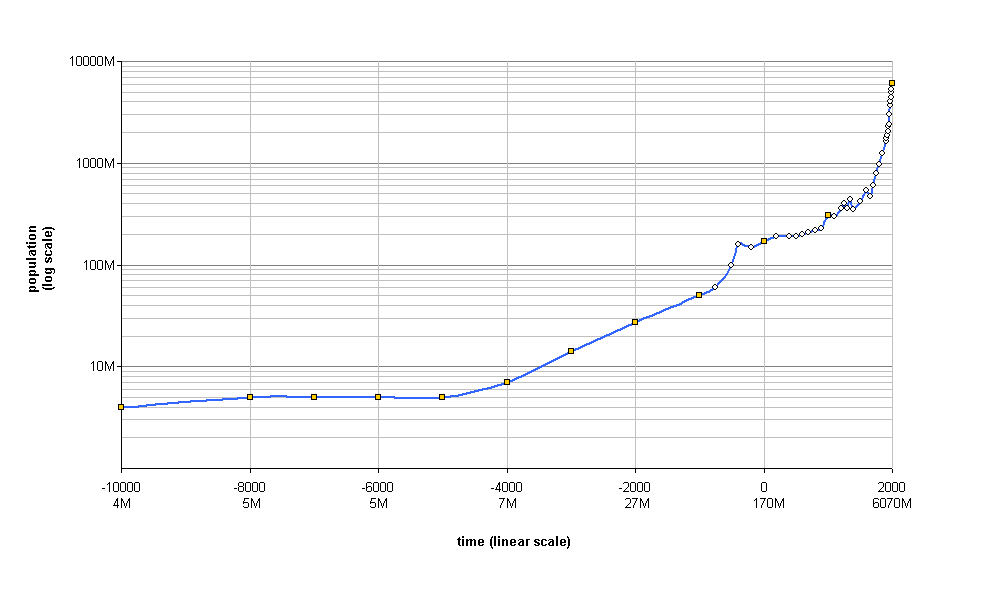

To conclude, effective corporate regulation is not just a Utopian nice-t0-have. It took till 1960 for World Population to hit 3bn. It has grown by 1bn approximately every 12yrs since, probably hitting the 7bn mark earlier this year. There are more human beings to house and feed today than have ever lived before. Presently, we have just over 2 acres of workable land each, 4x less than a century ago, and this is shrinking each moment as corporate activities and climate change destroy the natural world, and population continues to skyrocket.

Resultant biodiversity loss, whilst often second-ranked in current ‘problem’ trends is, as we’ve established, probably the most dangerous of all due to its inscrutable relationship with macroenvironmental instability. With extinctions currently at 1000x the background base rate, and predicted to rise to 10,000x over this century, we are very rapidly, and very blindly, removing the Jenga pieces of our life systems, largely for the sake of the short-term wealth creation of the small ‘groups’ of the corporate elite. History is littered with exemplars of total societal and environmental meltdown as the result of human impact on vulnerable ecosystems: Easter Island, The Mayans, The Pueblo Culture of the South Western USA, the Norse Greenland and Iceland colonies to name but a few. If we repeat the same mistakes globally, we may not get a second chance.

Resultant biodiversity loss, whilst often second-ranked in current ‘problem’ trends is, as we’ve established, probably the most dangerous of all due to its inscrutable relationship with macroenvironmental instability. With extinctions currently at 1000x the background base rate, and predicted to rise to 10,000x over this century, we are very rapidly, and very blindly, removing the Jenga pieces of our life systems, largely for the sake of the short-term wealth creation of the small ‘groups’ of the corporate elite. History is littered with exemplars of total societal and environmental meltdown as the result of human impact on vulnerable ecosystems: Easter Island, The Mayans, The Pueblo Culture of the South Western USA, the Norse Greenland and Iceland colonies to name but a few. If we repeat the same mistakes globally, we may not get a second chance.

Considering the twin pincers of population growth and biodiversity loss, it is quite evident that socioenvironmental stability and sustainability are our most important objectives for the c21st, bar none. Our very survival depends on achieving them and success is contingent upon economic and environmental policy which is underpinned by the principle of diversity=stability=good. If variety is both the spice and source of life, then we must put democratic pressure upon Government and business to make the small tweaks to our economic system necessary for it to produce abundance by its own workings.

For a fascinating and vitally important lesson in the importance of preserving and promoting biodiversity, Arkadian cannot recommend the video below more highly. Essential viewing for all inhabitants of Planet Earth.

The Root of all Evil: how the UK Banking System is ruining everything and how easily we can fix it.

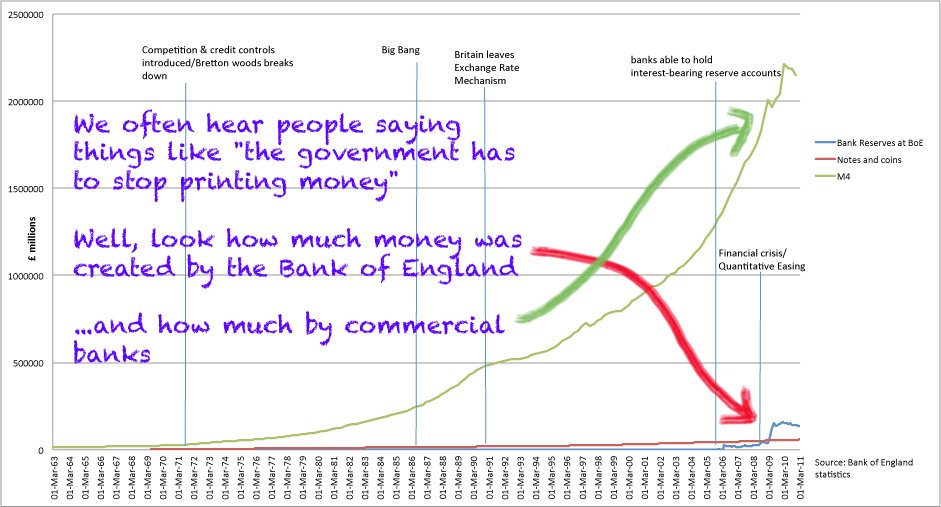

Whilst no economics ‘expert’, it has become clear to Arkadian from evidence presented by organisations such as Positive Money and the New Economics Foundation that the UK Banking System is (i) rapidly driving us into a new Dark Age and (ii) not nearly as difficult to understand as those with a vested interest in it would have us believe.

As positive change depends on a general understanding, the current article aims to compare, in simple terms, how this system has worked in the past, and should work, and how it works currently to the detriment of you, your children, your community and your future.

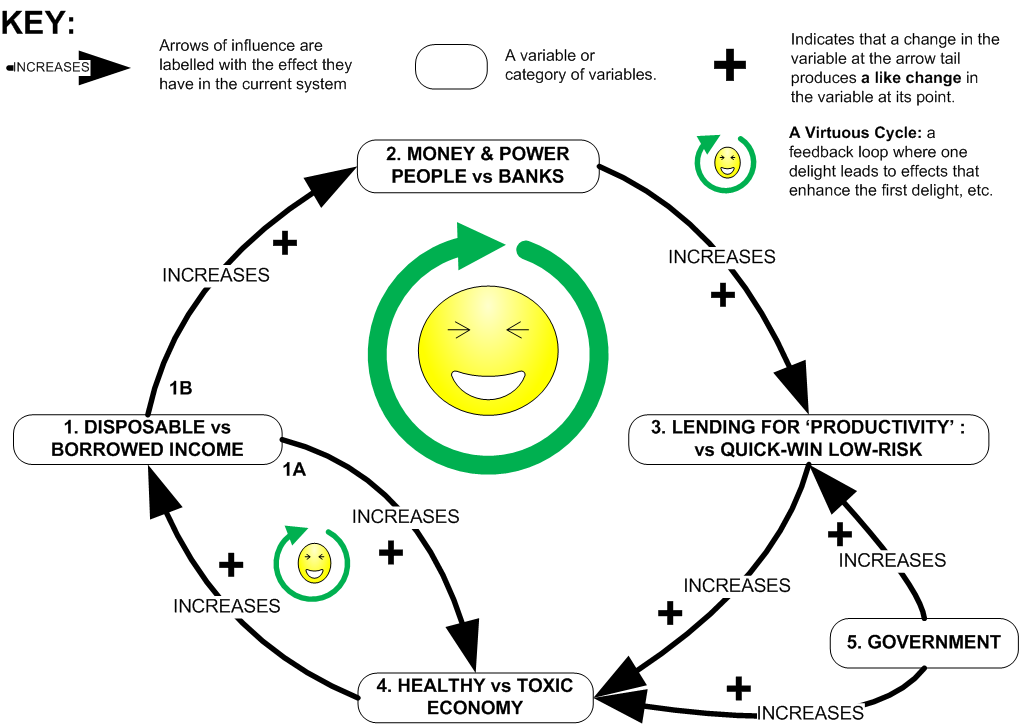

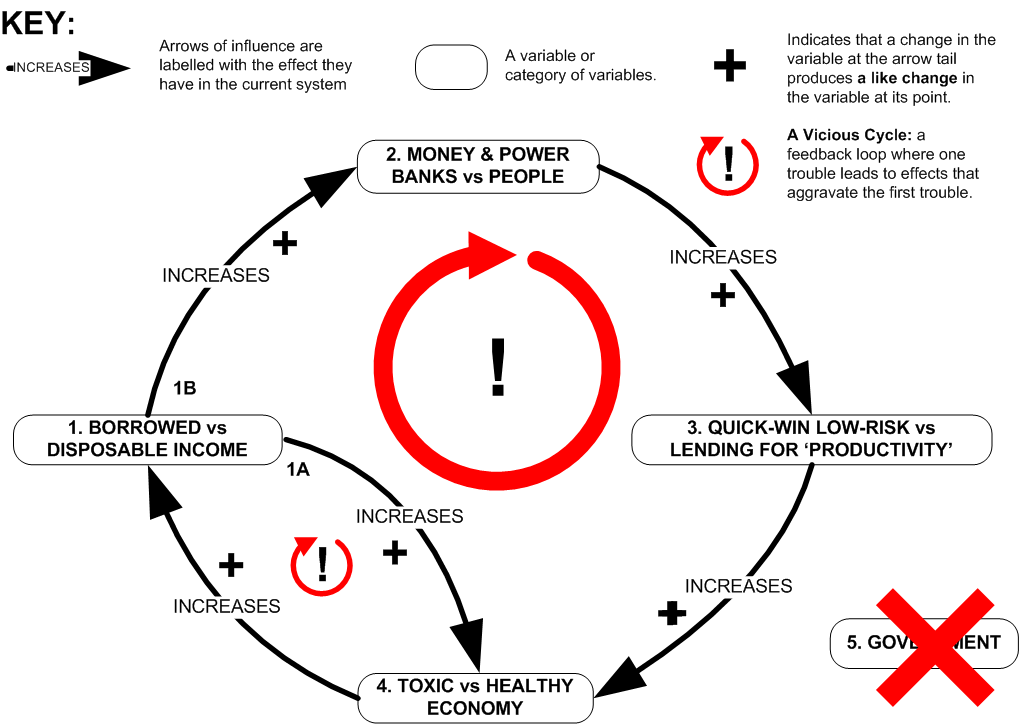

HOW IT WORKED (THE VIRTUOUS CIRCLE):

To begin, lets look at a diagram of how the UK economy worked in the years following WWII. At that time the country, as now, was stone broke but, unlike now, was driven by people-centred values sharpened in response to the Axis Power’s policies of dehumanisation. It is also a model of a ‘classic’ Capitalist System, as described by Adam Smith. Most people, and politicians, still mistakenly believe it works this way.

The arrows represent the flow of money, and the boxes: important ‘variables’ in the system. You can start anywhere, but it’s probably easiest to start with the box to the left.

1. Disposable vs Borrowed Income. You made a decent living in a secure job-for-life that allowed plenty of free time for friends and family. Your mortgage aside – which took around 10-15yrs max to pay off – you only bought things if and when you could afford them, thus putting money back into ‘circulation’ (arrow 1A). The remainder went into your savings account or share investments (arrow 1B) …

2. Money and Power: People vs Banks. …Banks were dependent on your savings to function as they were only permitted to lend in relation to their cash reserves. Their business worked by making money from the interest on these loans…

3. Lending for Productivity vs Quick-Win Low-Risk…As banks were still very much focused at a High Street level, much of their investment went into small businesses…

4. Healthy vs Toxic Economy…Thus your savings helped foster a growing, diversifying and stable local economy, which meant more secure jobs and, coming full circle, (1) more disposable income for other people to spend or save as well as a range of other social benefits associated with greater income equality.

5. Government, meanwhile, ‘governed’ the system to ensure it worked properly. In partnership with the Bank of England, they monitored the economy, periodically injecting new printed cash into the system to fill the ‘gap’ created by new growth, via public services that safeguarded citizens’ life dependencies (energy, social security, education, policing, health, telecoms, transport, postal service, military) and provided reliable employment for millions. They also regulated the banks to ensure they lent justly and responsibly.

And so it worked, by no means a well-oiled machine but still one guided by principles of fairness, general well-being, and economic restraint. So what’s changed?

HOW IT WORKS NOW (THE VICIOUS CIRCLE).

1. Borrowed vs Disposable Income. Whilst you (unlike many) may still make a decent living, you and your partner work doubly-hard out of fear of losing your jobs and being unable to meet your mortgage and debt repayments.

In your absence, your children are raised largely by others. Even when you’re home, it’s tough to find energy for them when what you need is relaxation from the stresses and strains. The cost of a property sufficient to comfortably house your family has meant you’re probably destined to spend your whole life surviving on credit and without savings…

2. Money and Power: Banks vs People…But isn’t ‘no savings’ an issue for the banks? Not anymore! Now, when you need to borrow, they are free to tap the number into a spreadsheet and create it for you out of thin air, irrespective of the amount of ‘savings’ in their reserves (arrow 1B) . They also decide your interest rate: the ‘money-for-nothing’ (quite literally) from which they’ve grown rich, politically-powerful and monolithic…

3. Quick-Win Low-Risk vs Lending for Productivity…And these global giants no longer have time for long-term, high-risk investment, such as small or ‘ethical’ businesses. They plough your ‘interest’ into quick-win low-risk high-return investments, which are safely recoupable should anything go belly up.

Around 90% goes int0 speculation, contributing virtually nothing to the economy, and, in the case of the food and currency markets, causing the suffering and deaths of millions in poorer countries. Much of the rest goes into property, and loans to big corporations that value short-term profit over the welfare of planet and people – fossil energy, mining, factory farming, mass media, consumer goods, processed food, the military etc.

4. Toxic vs Healthy Economy…Although in good times the economy appears to grow, growth no longer signifies health. Property prices inflate beyond the reach of many: notably, your descendants. Private monopolies supplant public services and local business, and we become increasingly dependent upon them for life essentials, employment, and a functional economy…

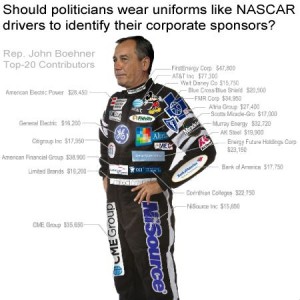

5. Government… So where are they in all this? Precisely! As mentioned in (2.), they’ve handed over the lion’s share of the responsibility for creating and managing the nation’s money to the financial sector. They’ve also permitted a few banks, and other monopolies, to grow so large and powerful that political success now hangs upon prioritising their interests over those of their electorate (with over half of Conservative Party funding now reliant on the banking sector and much of the remainder coming from defence, manufacturing and energy, is it any surprise that voter needs should come second to their sponsors’ return on their investment?) Whilst Whitehall may maintain the illusion of steering the British economy, technically they can’t because they’ve abdicated the controls.

And so the Vicious Circle turns, with each cycle the system becoming more unequal, uniform and unstable. There are three particularly vicious aspects of this system worth noting.

Firstly, it functions irrespective of recession. In boom, you borrow to get the things to which you aspire now rather than having to wait – using credit / store cards, bank loans, mortgages and the like – and the banks get rich and powerful. In bust, you borrow to make ends meet and the banks get rich and powerful.

Secondly, in a recession, because the vast majority of the money in the system is ‘borrowed’, to prioritise the repayment of the bank-invented debt (i.e. ‘Austerity’) over strategies for stimulating spending is guaranteed to shrink the economy further. Simply put, if pennies are taken out of the national purse and vanish into thin air without any being put back in, there will be less money in the purse. Unless, of course, we can find a bank to lend us a more.

Thus, whilst the historically-proven formula for economic recovery has always been to kickstart the Virtuous Circle through public spending and corporate regulation, in this sick misshapen world, crashes, austerity, privatisation and price hikes are great because they force us to borrow more, which indirectly results in new ‘imaginary’ money getting injected into the economy (arrow 1A).

And although a life of indebtedness for food, housing, clothes, education and so on, may promise an increasingly bleak existence for us and our children, for the environmentally-unconscious one-stop corporate shop that creates our credit, charges our interest, employs us as temps at the minimum wage, and is the only place where we can buy anything, it’s a field day.

Lastly, the unsustainability of this rampant money creation is largely irrelevant to the banks because, ultimately, the public debt is underwritten by the Bank of England, in other words, US! You, yes YOU, are effectively part-guarantor of everybody’s loan, including your own. The bubble will always burst, and more spectacularly each time, and it’ll always be you that is liable for the debt, never those that made billions from the recklessness.

Happily, fixing the system is remarkably simple. You have two choices. The easiest is to pick up the phone and (1) MOVE YOUR MONEY out of the Vicious Circle and into an ethical bank such as The Coop or Triodos, who maintain a responsible lending policy, consult you on your ideas for a better future and invest in them – organic farming, renewables, community development and so on – rather than whatever horror brings in the profits. Do it now and enjoy looking your children in the eye with a clear conscience!

(2) is to PUT PRESSURE ON YOUR GOVERNMENTAL SERVANTS to re-impose the vital framework that regulated the Virtuous Circle.

Most critically, this means returning the responsibility for money creation to The Bank of England. Exercise of this responsibility should involve the immediate injection of real cash into circulation (‘quantitative easing’) via investment in a growing public sector and green transition. This would reduce our economy’s toxic dependence on debt to function, generate employment and spending (the only way out of recession), and begin the change upon which a tolerable future hinges.

Close second, however, involves excising the corporate influence from our political system and allowing the democratic needs of citizens to determine Governmental decision-making, and not the insatiable greed of a small commercial oligarchy.

Thirdly, the ‘ecology’ of the financial sector should be regulated so that a significant percentage of banks are always focused on investment at the local level. This is the approach in Germany, and the greater diversity and stability of their banking system has enabled them to weather the present storm significantly better than most.

In short, if you wish to remain in a world where you are dependent on corporate monopolies for your existence, and where the conditions of your life and planet are certain to deteriorate, then sit back and do nothing. However, if you’d prefer a return to a financial system that works towards the common good then MOVE YOUR MONEY NOW!

A concluding thought: in The Early Middle Ages we were told the Bible was only comprehensible and communicable by The Church. It was a tale that, for a considerable time, maintained vision, interpretation, practice and power in the hands of an elite few.

Arguably, the translation of the Bible from Latin into English and its popular dissemination was one of the driving forces behind the development of the more market led and equitable society of later centuries. Knowledge, as they say, is power.

In the c21st our ‘mystery’ is The Economy, our priests: the politicians, economists and bankers. Pah! Economics is easy, isn’t it? It’s just about how we can make money work best for us and our loved ones.

So go on: inform your friends and family. Ask them to move their money too. It’s time to debunk the ‘priesthood’ and reclaim control over our lives, planet and future. Forever and ever. Amen!

Want to know more? Arkadian highly recommends following Positive Money or the New Economics Foundation on Facebook, or watching the illuminating video below. Learn and share!:

What the One Demand of the ‘Occupy’ Movement should be and why.

Today was Occupy Wall Street’s first Global Day of Action. We’re on our way home from our local urban occupation, feeling inspired, hopeful and slightly unsettled. Inspired and hopeful because people of all ages and backgrounds from around the world joined in protest against a corrupt economic system; unsettled due to a heated difference of opinion about what to do and who to battle (thankfully, and topically, resolved democratically and peaceably).

History is strewn with social movements that imploded through infighting, or where, for lack of a clear aim, the chaotic forces of moral indignation were steered by groups, with a plan and organisation, towards their own agenda (and, usually, more of the same). For either to happen to this beautiful movement would be a tragedy of inestimable proportions.

So is there a single aim that could unite the 99%?

The answer to this, we believe, lies in a further question: how is it that in a democratic system the 99% can be so flagrantly disregarded? This points to a problem with the machinery of Democracy itself. Perhaps, if we could locate the faulty part and fix or replace it, these diverse opinions would be enriching collective solutions rather than jeopardising their own vehicle for liberation?

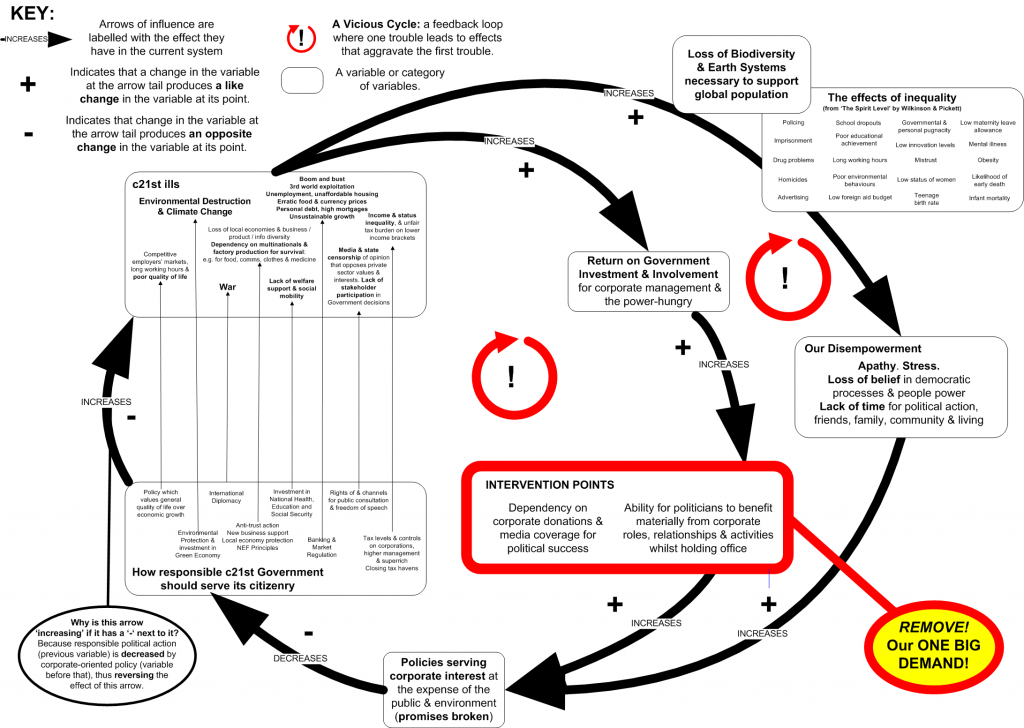

There follows a 2-part systems dynamics analysis to this end.

PART 1 proposes two Vicious Circles at work in the current system. These are series of events where one trouble leads to troubles that further aggravate that first trouble, and so on

(N.B. It’s easiest to click on the diagram to open it in a new browser and then refer back to the explanation here. Depending on your screen size, you may also need to zoom in-and-out in order to read the smaller text by clicking on the relevant area).

The best place to start is at the bottom where government policies that serve corporate interests are pursued at the expense of those that serve the 99% and the natural environment.

Whilst this enriches the 1% and motivates them to even greater future investments in manipulating Government policy (the 1st Vicious Circle – inner), it also exacerbates a range of hugely-profitable (in the short-term) c21st century ills: war, recession, inequality, loss of public services and assets, our increasing dependency on corporations for life’s essentials and, most critically, a severe threat to Earth’s life systems.

These factors, together with diminishing quality-of-life and broken political promises intensify our apathy and denial, and reduce time or inclination for political action, thus eroding a key constraining factor on the corporate policy abuses with which we began (the 1st Vicious Circle – outer). And so the Circles turn.

The analysis suggested two potential intervention points (highlighted in red) where action could positively transform the Vicious Circles. These are: –

(1) Dependency on corporate relationships for political success. In short, a business wouldn’t bestow cash or media coverage on a political campaign that didn’t promise a significant return on investment. A third of the world’s 100 largest economic entities are now transnational corporations. Without bowing to these giants, no party has a hope of achieving or maintaining office, irrespective of good intentions and promises. Why pursue a policy or preserve a public service, asset, safeguard or freedom when losing it stands to make somebody a tidy profit?

(2) Ability for politicians to benefit materially from political office as a result of corporate relationships. Whilst we do not share many of Plato’s views (on Democracy, for example), we do agree that the worst form of government is one where the actions that satisfy the desires of the ruler become law. A tyranny. It was with good reason that The Republic went to great pains to isolate its philosopher kings from the temptation of riches and military stardom, the great corruptors of wise governance.

Under the Republic, for example, a former Prime Minister who made $40bn out of a dubious war he instigated whilst in office or a secret council assembled to draft laws to serve its own self-interest would have faced certain execution.

To put it simply, if we wish our countries to be run by people motivated by a desire to serve its citizenry and not by material self-interest then, within the political sphere, constraints on the latter must be codified in law and regulated independently. After all, corporate management takes conflict-of-interest very seriously. They know, as Plato did, that a person cannot responsibly wear two hats when money is involved.

To put it simply, if we wish our countries to be run by people motivated by a desire to serve its citizenry and not by material self-interest then, within the political sphere, constraints on the latter must be codified in law and regulated independently. After all, corporate management takes conflict-of-interest very seriously. They know, as Plato did, that a person cannot responsibly wear two hats when money is involved.

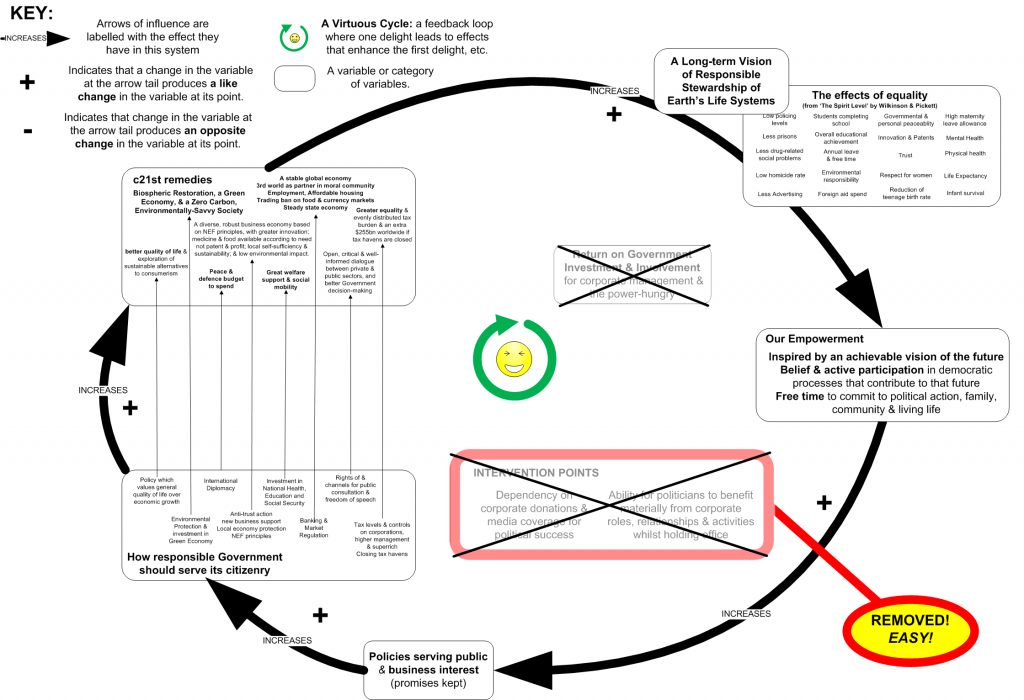

For PART 2 of the analysis the ‘Occupy’ Movement collectively waves its magic wand and divorces the public and private sectors, turning our Vicious Circles into its cheerful alter ego, a Virtuous Circle, where a delight leads to delights that further promote the first delight, and so on

(N.B. Again, it’s easiest to click on the diagram to open it in a new browser and then refer back to the explanation here. Depending on your screen size, you may also need to zoom in-and-out in order to read the smaller text by clicking on the relevant area)

Here, diverse opinion (with better access to information about actual environmental and economic constraints) is braided via participatory democratic processes and well-behaved politicians into policies that best serve both public and private interest.

This leads to a host of positive socioenvironmental effects that increase faith in people-power, government and the future. It also confers the time to get involved, thus contributing to even greater participation and ever richer solutions. And so the Virtuous Circle turns: driven by a commitment to a better world in the long-term.

Call us idealistic, but we believe this vision of an equitable sustainable society where stakeholders are actively engaged in Government is wholly imaginable, achievable and necessary. Moreover, It will not require earth-shattering change and would improve general quality-of-life.

However, we acknowledge that, as evidence of the Arkadian worldview – steady state economics, new economics principles, Just Transition , equality, environmental restoration, nurturing new values etc. – seeps in here, it would be best to declare the pertinent aspects. We ask that anybody who posts comments extends us the same courtesy as it makes discussion of opinions easier and so much more fruitful.

“Arkadian Systems Worldview: That the current economic system has been proven environmentally unsustainable and thus we must explore and enact alternatives or risk socioenvironmental collapse and extinction. That social and environmental justice are so intimately intertwined that treatment of one leads inevitably to reinforcing effects on the other. That decision-making is always wiser when all stakeholders with an interest in the relevant situation are meaningfully involved. ”

We should also stress that it is only the last of these – the principle underpinning a true Participatory Democracy – that should be considered relevant here. If Democracy is reformed and re-fired, we’re confident the rest will happen all by itself, the right way, and our opinion will be one of millions that make a contribution. So, to conclude,

The One Demand of the ‘Occupy’ Movement should be:

“GET BUSINESS OUT OF POLITICS AND LET THE PEOPLE IN”:

Insert a robust legal and regulatory framework between the private and public sectors, which enables Government to draft policy and law without conflict-of-interest and according to the principles of Participatory Democracy

Specifically, this framework should render it impossible for politicians to benefit materially from political office as a result of corporate relationships and should define equitable and corporate-independent alternatives to campaign funding .

For us, this is eminently preferable to smashing the bankers, police, politicians, Capitalism, Consumerism: THE SYSTEM. Trying to fight The System or one of its organs, inevitably results in giving oneself a bloody nose and the awful realisation that, yes, it also includes ME!

Recent Posts

- Seeding a Viable Economic Alternative. Pt 3: Placing Mother Nature First

- Seeding a Viable Economic Alternative. Pt 4: Ego-as-Process

- Charlie Hebdo and the Immorality Loop

- My Top 20 Waterfalls Pt3 (S America: #2-1)

- My Top 20 Waterfalls Pt2 (S America: #7-3)

- My Top 20 Waterfalls Pt1 (Africa, Asia, Europe & N America)

- Positive Change using Biological Principles, Pt 4: Principles in Action

- Positive Change using Biological Principles Pt 3: Freedom from the Community Principle

- Positive Change using Biological Principles Pt 2: The missing Community Principle

- Positive Change using Biological Principles, Pt 1: The Campaign Complex

- Seeding a Viable Economic Alternative. Pt 2: The Principal Themes (Outcomes of a Systems Workshop at Future Connections 2012)

- Seeding a Viable Economic Alternative. Pt 1: The Action Plan (Outcomes of a Systems Workshop at Future Connections 2012)

- What I Learned from Destroying the Universe

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 5 of 5: How do We Create a Diverse and Stable Economic System?

- The Root of all Evil: how the UK Banking System is ruining everything and how easily we can fix it.

- What is Occupy? Collective insights from a ‘Whole Systems’ Session with Occupy followers

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 4 of 5: Why does the current Economic System tend towards Uniformity and Instability?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 3 of 5: Why does A Diverse System = A Stable System?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 2 of 5: Why does (did) Civilisation tend towards Diversity and Stability?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 1 of 5: Why do Ecosystems tend towards Diversity and Stability?